One of the largest elements for customers looking to purchase cars and truck insurance policy is the cost. business insurance. Not just do rates differ from business to company, yet insurance coverage expenses from state to state differ.

Ordinary rates differ widely from state to state. Depending on ordinary cars and truck insurance costs to approximate your car insurance premium may not be the most precise method to figure out what you'll pay.

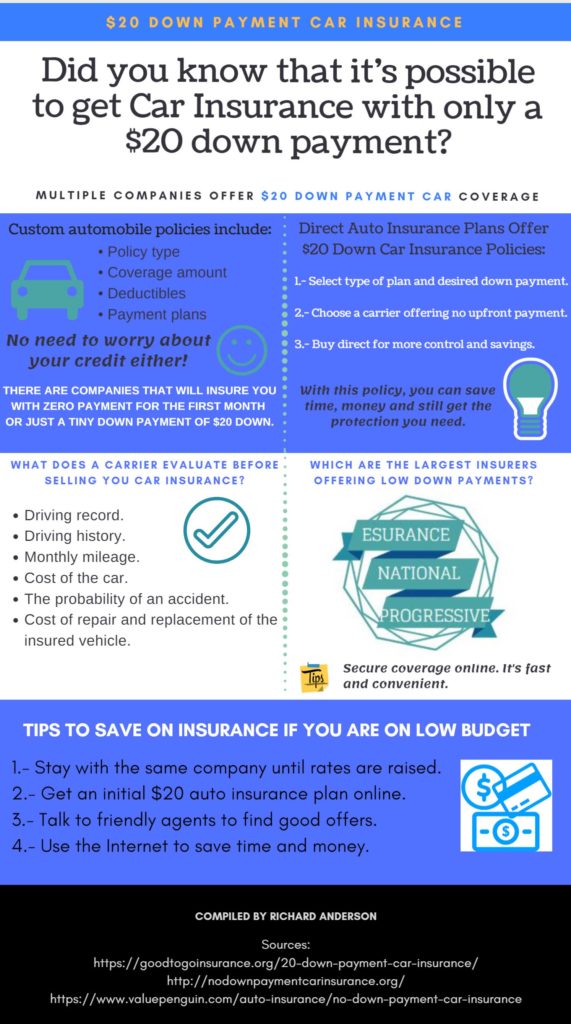

Insurance providers use multiple factors to figure out prices, as well as you may pay essentially than the ordinary motorist for protection based upon your danger account. More youthful chauffeurs are generally extra likely to obtain into a mishap, so their costs are usually greater than standard. You'll likewise pay more if you have an at-fault crash, numerous speeding tickets, or a DUI on your driving document.

It may not supply ample security if you're in a crash or your car is damaged by an additional covered incident. Interested regarding exactly how the ordinary cost for minimal protection piles up versus the cost of full protection?

The only means to understand precisely how much you'll pay is to go shopping about and get quotes from insurance providers. automobile. One of the elements insurers utilize to determine prices is place. People that reside in areas with greater theft prices, accidents, and also all-natural disasters commonly pay even more for insurance policy. And also because insurance policy legislations and also minimal coverage requirements vary from state to state, states with higher minimum requirements normally have higher average insurance prices.

Not known Details About Average Car Insurance Cost For 17-year-olds - Insuraviz

Most yet not all states allow insurer to utilize credit history when setting rates. As a whole, applicants with lower scores are much more most likely to sue, so they typically pay a lot more for insurance than chauffeurs with higher credit report (cheap car insurance). If your driving record includes accidents, speeding tickets, DUIs, or various other offenses, anticipate to pay a greater premium.

affordable insurance companies cheaper cars cheap insurance

affordable insurance companies cheaper cars cheap insurance

Autos with higher rate tags typically set you back even more to insure. Vehicle drivers under the age of 25 pay higher prices due to their absence of experience and increased crash danger.

Because insurance business tend to pay even more claims in risky locations, prices are usually greater. Getting married generally leads to reduced insurance policy premiums. Getting appropriate protection may not be low-cost, yet there are ways to obtain a price cut on your car insurance. Here are five usual discount rates you may get approved for.

If you possess your home rather than leasing it, some insurance firms will certainly provide you a discount rate on your auto insurance costs, even if your home is insured via an additional business. Various Other than New Hampshire and Virginia, every state in the country needs drivers to keep a minimum quantity of obligation protection to drive lawfully (insurance).

It may be tempting to stick with the minimum limits your state calls for to Click for more save money on your premium, yet you can be putting yourself in jeopardy. State minimums are infamously low and can leave you without adequate defense if you remain in a major mishap. The majority of specialists advise keeping sufficient insurance coverage to safeguard your possessions.

Car Insurance - Racq Can Be Fun For Everyone

Looking into for the best insurance policy firm that fulfills your demands is typically the very first step, however you likely have questions concerning insurance coverage companies, policies, and prices. When comparing quotes, you may ask yourself, what is the average expense of car insurance coverage? It's useful to understand the variables that can influence your automobile insurance coverage prices.

On an annual basis, car insurance coverage expenses generally fall between $926 and also $2,534 each year per vehicle, yet these costs can differ based on the area, company, as well as protection selected. Below are some of the elements that influence the expense of cars and truck insurance policy: State and also location Your geographical place might play an essential function in figuring out the premium amount for your auto insurance.

Some states also require Injury Security (PIP) coverage and some areas consider climate and also environment when establishing auto insurance prices. Discover about what auto insurance policy is required in your state. Age As a motorist with dependable auto insurance coverage, your rates will likely rise and fall gradually, relying on your age. affordable auto insurance.

This is generally due to lack of experience and harmful driving practices. Based on this information, teenager and also senior chauffeurs might pay even more when buying automobile insurance policy than middle-aged vehicle drivers (liability).

New automobiles can be expensive to guarantee due to the fact that they feature new components and greater replacement values than older makes as well as designs. Contemporary cars geared up with security functions and also tracking abilities, might be cheaper to insure. Car dimension can additionally impact car insurance coverage prices. In the past, SUVs were normally more pricey to insure than coupes or cars, yet this can likewise rely on the type of SUV as well as some versions might be less pricey to insure than others.

Monthly Or Annual Auto Insurance Premium: Which Is Best For ... Fundamentals Explained

Annual mileage When looking into just how much car insurance must set you back, keep in mind that insurance coverage costs are based primarily on the danger connected with your lorry. Driving document Your driving record assists address the concern: how much should I be paying for cars and truck insurance? Auto insurance providers typically pay attention to a person's experience as well as driving record.

low cost car suvs perks

low cost car suvs perks

A wedded vehicle driver can pay up to $96 less per year for their cars and truck insurance policy. Incorporating auto insurance coverage with residence insurance coverage is a simple way to conserve on your car insurance coverage costs.

car insurance risks low cost auto insurance

car insurance risks low cost auto insurance

State Farm, Travelers, and also Nationwide additionally have insurance policy prices that are less costly than the national standard, according to our study. That said, there are a great deal of variables that influence just how much you'll spend for cars and truck insurance coverage, as well as we'll take a look at some of them below. These car insurance coverage pricing elements include your age and also various other market info, your credit rating and credit rating, your driving document, as well as whether you purchase minimal protection or full coverage.

Vehicle insurance policy business normally take into consideration variables such as your age, sex, marital status, house address, credit rating, driving document, as well as the kind of car you drive, together with the insurance policy regulations as well as policies in your state. Purchasing around is the very best way to find the most effective cars and truck insurance policy rates (credit score). See to it to contrast quotes from several various insurance provider.

What Does Average Monthly Car Insurance Rates In Alberta - Brokerlink Mean?

Our study identified ordinary automobile insurance policy prices for a selection of client teams, there are a lot of individual factors that may make your prices reduced or greater than those revealed right here., as well as other ways to reduce prices.

For an 18-year-old taking out a policy, they can anticipate it to be roughly $688 per month or $8,250 yearly. They pay roughly $1,977 per year.

The ordinary costs for car insurance coverage in Toronto is simply over $2,000 yearly - low cost auto. In Brampton it has to do with $2,400 annually, which is the highest possible in the district. The most affordable area is the northeastern area of the province. Cities such as Kingston as well as Belleville average regarding $1,000 each year.

London is regarding $1,400 every year. Mississauga mores than $2,000 annually. Hamilton is about $1,600 every year. A few other variables that affect rates for car insurance coverage Lots of points have a straight influence on the cost of auto insurance coverage. Some you have control over (what you drive, driving history) and also others you do not (insurance market factors).

There are also specific factors to consider you can not regulate, such as your age as well as gender. Will the cost of insurance go down for vehicle drivers? Even though the Ontario rural federal government has actually made promises to obtain insurance under control, the annual standard costs are still on the rise.

Safeco Insurance - Quote Car Insurance, Home Insurance ... - Truths

Nonetheless, individuals are beginning to obtain a break to some level. You need to take important actions to lower repayments such as contrasting quotes each year to obtain the most inexpensive vehicle insurance coverage and functioning with an insurance specialist. In terms of age, you can anticipate to start seeing reduced costs once you transform 25.

In this article, Component 1 discusses the significance of knowing your regular monthly fee, Part 2 shows you exactly how to determine month-to-month prices, and Part 3 describes exactly how to compare the results. Component 1 of 3: The significance of understanding your regular monthly costs, There are a few reasons why you could need to know what your regular monthly insurance coverage price would be.

For an 18-year-old obtaining a policy, they can expect it to be approximately $688 per month or $8,250 annually. Contrast this to the common quantity of a 40-year-old, and also you'll see a significant distinction. cheaper cars. They pay roughly $1,977 annually. Why so a lot of a difference? Teens are a greater danger to road security.

The average premium for car insurance in Toronto is just over $2,000 annually. In Brampton it has to do with $2,400 yearly, which is the greatest in the district. The most affordable location is the northeastern area of the province. Cities such as Kingston as well as Belleville typical regarding $1,000 each year.

Some other factors that impact rates for vehicle insurance Lots of points have a straight effect on the price of car insurance coverage. Some you have control over (what you drive, driving history) and also others you do not (insurance policy industry variables).

Everything about How Much Does Car Insurance Cost By State? - Progressive

accident insurance companies affordable cheaper car insurance

accident insurance companies affordable cheaper car insurance

Having an at-fault accident on your document indicates higher insurance. There are also specific considerations you can not regulate, such as your age and also sex. For more details please most likely to our web page and see what elements affect Ontario car insurance coverage estimates. Will the cost of insurance policy go down for vehicle drivers? Despite the fact that the Ontario rural federal government has made promises to obtain insurance policy under control, the annual standard costs are still growing.

Individuals are beginning to get a break to some level. You need to take important steps to decrease repayments such as contrasting quotes every year to get the least expensive auto insurance policy and dealing with an insurance coverage professional. In terms of age, you can expect to start seeing lower costs when you transform 25 (credit score).

trucks laws cheaper auto insurance liability

trucks laws cheaper auto insurance liability

In this short article, Component 1 talks about the significance of understanding your regular monthly fee, Component 2 reveals you just how to determine regular monthly costs, as well as Component 3 clarifies how to contrast the results. Part 1 of 3: The relevance of understanding your month-to-month premium, There are a few reasons that you could would like to know what your month-to-month insurance coverage cost would be.

For an 18-year-old obtaining a policy, they can expect it to be around $688 each month or $8,250 annually. Compare this to the regular quantity of a 40-year-old, and also you'll see a significant difference. They pay about $1,977 annually. Why a lot of a distinction? Teenagers are a better threat to roadway safety and security.

In Brampton it is concerning $2,400 yearly, which is the highest possible in the province. Cities such as Kingston and also Belleville ordinary about $1,000 per year.

The 4-Minute Rule for How Much Is Car Insurance? - Nationwide

London has to do with $1,400 yearly. Mississauga is over $2,000 every year. Hamilton is about $1,600 yearly - car insurance. A few other factors that affect rates for car insurance Numerous things have a direct impact on the cost of vehicle insurance policy. Some you have control over (what you drive, driving history) as well as others you don't (insurance policy sector aspects).

There are likewise private considerations you can not regulate, such as your age and sex. Will the price of insurance policy go down for drivers? Also though the Ontario provincial government has actually made assurances to get insurance policy under control, the annual average costs are still on the surge.

People are beginning to get a break to some level - cheaper car insurance. You need to take important steps to minimize payments such as contrasting quotes yearly to get the most inexpensive auto insurance as well as collaborating with an insurance policy specialist. In terms of age, you can anticipate to start seeing lower costs as soon as you transform 25.

In this post, Component 1 talks about the relevance of recognizing your month-to-month fee, Part 2 reveals you exactly how to calculate month-to-month expenses, as well as Component 3 discusses how to compare the outcomes. Part 1 of 3: The importance of knowing your month-to-month costs, There are a couple of reasons why you may want to recognize what your monthly insurance policy cost would certainly be - vehicle.