Older people are also more probable to have actually resided in the same area longer and also recognize the local roads much better. credit." The concept that females are more secure drivers than guys is not simply anecdotal. According to Barry, years of insurance coverage information show that women are, typically, less likely than guys to sue.

According to the research study, a solitary 20-year-old male motorist will pay 23 percent greater than his female counterpart. Fortunately for men is this distinction begins to substantially level off as male motorists age. A solitary 25-year-old male chauffeur will only pay an average of 4 percent much more for car insurance than his women counterpart - low cost auto.

"Throughout the board you see boys paying much more for insurance, which makes feeling," states Barry. "Statistically, young guys are riskier vehicle drivers, which indicates they are, usually, much more expensive to guarantee." According to the Hawaii Division of Commerce as well as Customer Affairs' Insurance Coverage Division, Hawaii is the only state that doesn't allow cars and truck insurance companies to utilize age, sex, or length of driving experience when setting prices (cheapest auto insurance).

insurance suvs vans cheaper car insurance

insurance suvs vans cheaper car insurance

Usually, a single, 20-year-old male will pay 24 percent much more for car insurance policy than his married equivalent. And for a single, 20-year-old female the difference is 28 percent. "The way marriage condition plays a function in establishing costs can be a controversial concern, however it's based on the presumption that people particularly young individuals get more significant about being better motorists when they're married," claims Bob Hunter, former Texas Insurance policy Commissioner and present supervisor of insurance at the Washington, D.C. auto.-based Consumer Federation of America, a consumer advocacy organization.

How When To Take Your Child Off Your Car Insurance - Nationwide can Save You Time, Stress, and Money.

A single, 25-year-old male driver will just pay 9 percent much more for car insurance than a 25-year-old married male. Whether you're male, women, wedded or single, here are some suggestions for reducing the price of auto insurance: 1.

The price of automobile insurance policy is always transforming. Study method: insurance policy, Prices estimate.

Know the factors affecting cars and truck insurance policy premiums and also discover how to decrease insurance coverage expenses. You pay one quantity for automobile insurance coverage, your best buddy pays another and also your neighbor pays still one more amount.

insured car car insured insurance company vehicle insurance

insured car car insured insurance company vehicle insurance

The opposite can use for less secure flights. Some insurance providers enhance costs for cars more prone to damages, occupant injury or theft and they lower rates for those that get on better than the standard on those measures.

Excitement About How Much Is Car Insurance For 25-year-olds? - Coverage.com

Does the car that has captured your eye have solid security rankings? Knowing the answers to a couple of straightforward inquiries can go a long means toward keeping your rates low.

, metropolitan drivers pay even more for cars and truck insurance coverage than those in tiny towns or rural locations.

If you've been accident-free for an extended period of time, do not obtain complacent. Stay careful and also keep your great driving practices. If you are insured as well as accident-free for 3 years, you likely receive a State Take a look at the site here Farm accident-free cost savings - low cost. And even though you can't reword your driving history, having an accident on your record can be an important pointer to always drive with care and treatment.

Your credit rating background Particular credit rating information can be anticipating of future insurance claims. Where applicable, numerous insurance provider use credit rating to help establish the price of car insurance policy - cheaper cars. Preserving good credit report might have a positive impact on your vehicle insurance prices. Your age, sex and also marital standing Mishap prices are greater for drivers under age 25, particularly solitary men.

Some Ideas on How Does Age Affect Car Insurance Premiums? - Ratecity You Should Know

If you're a student, you could be in line for a discount rate. Many cars and truck insurance providers supply discount rates to student chauffeurs who keep great grades. What are methods to help reduced auto insurance policy premiums? Dropping unneeded coverage, increasing your insurance deductible or lowering insurance coverage limits may aid reduced insurance policy costs. Your insurance coverage representative can share the pros and cons of these alternatives.

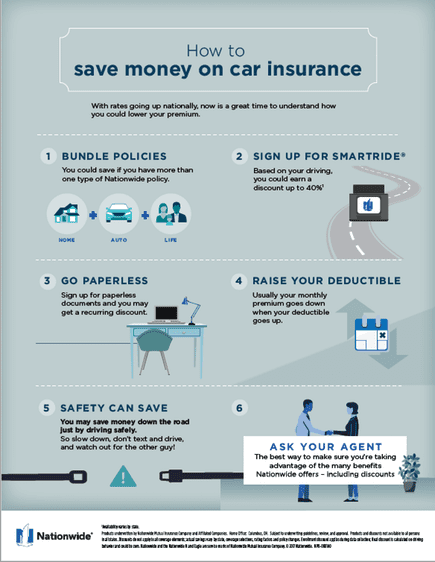

On the whole, it does not harm and also could very well help. These use based cars and truck insurance coverage programs document exactly how you drive and also the miles you drive., occasionally called bundling, can save you cash.

money cheap cars car

money cheap cars car

liability suvs money insurance

liability suvs money insurance

Car insurance does go down at 25 - cars. The typical price of vehicle insurance coverage for a 25-year-old is $3,207 for an annual policy.

Indicators on Car Insurance Rate Increases & How Premiums Are Determined You Need To Know

Our evaluation found that prices decrease much extra at various other one-year periods (auto). Keep reading to get more information information about when cars and truck insurance coverage does decrease. When does cars and truck insurance policy obtain less costly for young chauffeurs? Given they preserve a tidy record, young motorists will likely see their cars and truck insurance policy decrease after every year driving on the road yet just how much it really decreases by varies from year to year.

What age does vehicle insurance coverage drop for male vs female vehicle drivers? Your cars and truck insurance policy does drop after you turn 25, but not as much as it does on other birthday celebrations. However, unless you reside in a state where insurance firms can't factor gender into insurance rates, one significant modification take place at age 25: the distinction in between what man and female motorists pay for car insurance (auto insurance).

Does cars and truck insurance from significant national insurance firms drop at 25? We analyzed quotes from four of the biggest vehicle insurer Geico, State Ranch, USAA and Progressive as well as discovered that while automobile insurance policy does decrease at 25 with each of them, the quantity it decreases by differs substantially - vehicle insurance.

Unless you reside in among the couple of states that have actually made it prohibited, a reduced credit report score may enhance your automobile insurance premiums. If you transfer to an area with higher rates of burglary and vandalism, after that insurers will bill you greater premiums to represent the boosted risk of damage or burglary.

The 15-Second Trick For Average Car Insurance Cost - Root Insurance

Every insurance company calculates prices in different ways, as well as some insurance provider will highlight various factors much more heavily than others. We recommend reassessing your insurance firm yearly to obtain the very best price. insure. How to get less expensive vehicle insurance as a 25-year-old driver If you're a young driver in your 20s, you have actually most likely wondered how to decrease your auto insurance coverage expenses.

Strategies for exactly how to make your car insurance drop By the time you hit age 25, you have actually likely passed the point where you can remain on your parents' insurance policy. (If you have not, however, you must certainly do so, considering that this is among the most effective methods for young chauffeurs to save on their premiums.) Fortunately, there are various other methods for 25-year-olds to obtain their insurance policy rates to go down.

As your auto's value diminishes over time, however, consider decreasing or eliminating accident as well as extensive coverage. If your cars and truck is just worth a few thousand bucks, it doesn't make feeling to fork over for high costs to cover a property of restricted value. If you're wed and each of you drives different cars and trucks, you may be able to decrease your vehicle insurance payment by, as insurance companies consider married couples more solvent and risk-averse.

Discounts for 25-year-old motorists As you shop around for the ideal rate, ensure you're also asking insurance coverage companies about all suitable price cuts. Twenty-five-year-old chauffeurs may not have the ability to take benefit of student-away-from-home or good-student policies, but there are lots of other ways these young vehicle drivers can conserve on vehicle insurance policy: You could not be able to get a good-student price cut any longer, but your university may have partnered with an insurance coverage business to safeguard discount rates for alumni (cheap auto insurance).

Some Known Questions About Teen Drivers, Insurance And Safety - Official Website.

By taking a, you'll not just discover how to drive even more securely, yet you can decrease your automobile insurance premium anywhere from 5% to 20%. Be suggested, however, that some states as well as some insurance companies just expand this price cut to elders or vehicle drivers under 25. Talk to your insurance coverage firm to see if you qualify before you enroll in a class.

Does your automobile have certain security features, such as anti-lock brakes or daytime running lights? You might get a vehicle price cut due to it. Inquire about these discount rates when you call insurance coverage business for a quote. You might be surprised at the savings you're able to generate simply by asking concerns.

Lots of elements enter into play when insurance providers compute the price of auto insurance coverage - and also age is absolutely one of the major ones. If you desire to obtain on the roadway to commute to function or college or for leisure functions, you could discover that cars and truck insurance coverage is incredibly costly.

Age as well as car insurance policy As a basic general rule, you can anticipate to pay one of the most for your auto insurance policy when you're under 25. Once people more than 25, they have a tendency to find that the expense of their vehicle insurance coverage starts to fall. The cost usually declines slowly between the ages of 25 and 60.

When Does Car Insurance Go Down Things To Know Before You Get This

Insurance providers do not understand now exactly how most likely it is that such a chauffeur will make a case, so they bill even more to make certain they are covered - liability. Danger Car insurance premiums are calculated by taking risk into consideration. Statistically, younger vehicle drivers make more claims, so they are greater danger.

Can I reduce the cost? While there's no refuting that chauffeurs aged between 17 and also 25 pay the most for their auto insurance, there are some things you can do to ensure you pay less than you require to (prices).

If you do get a better quote, you might ask your existing insurance firm to match it - vehicle insurance.

The amount you'll pay for car insurance is impacted by a number of really different factorsfrom the type of protection you have to your driving document to where you park your automobile. You may likewise pay more if you're a brand-new chauffeur without an insurance policy track record. The more miles you drive, the even more chance for mishaps so you'll pay even more if you drive your automobile for work, or use it to commute long distances.